- Rust implementation as the backend.

- Improve performance reporting tools.

- Add more performance metrics and visualization features to the reporting tool.

- Add live trading support.

- Level 3 Market-By-Order backtesting.

- Data fusion to provide the most frequent and granular data using different streams with different update frequencies and market depth ranges. (WIP:

feature: unstable_fuse) - Adjust feed and order latency for exchanges located in different regions if the original feed and order latency data was collected at a different site.

- Additional queue position model or exchange model.

- A vector-based implementation for fast L2 market depth within the specified ROI (range of interest).

- Add fee model: fee per trading value (current), fee per trading quantity, fee per trade, and different fees based on the direction. (@roykim98)

- Parallel loading: Load the next data set while backtesting is in progress.

- Add a modify order feature.

- Support Level 3 Market-By-Order for Live Bot.

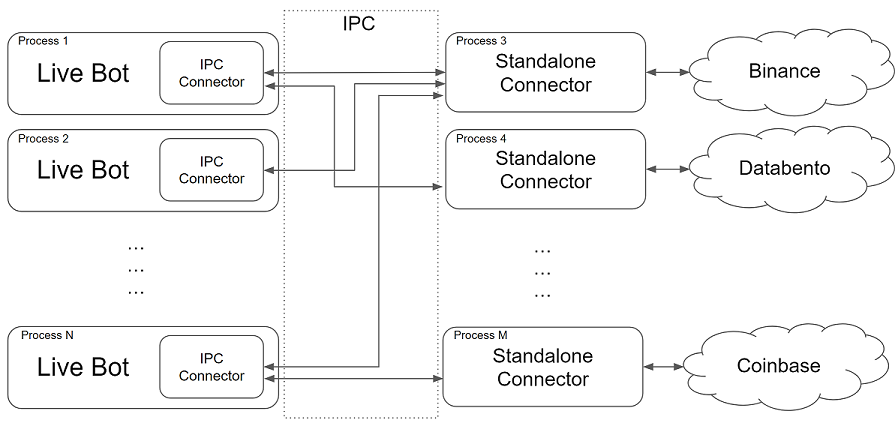

- Support external connectors through IPC for multiple bots via a unified connection. (WIP:

branch: ipc (PR-129))

- Implement Binance Futures Websocket Order APIs; currently, REST APIs are used for submitting orders.

- Add Binance market depth management mode; currently, only natural refresh is supported.

- Binance COIN-m Futures/Spot/Options

- Bybit

MVP - OKX

- Coinbase

- Kraken

- CDC

- Databento for the data feed

- Trad-fi

- Increase documentation and test coverage.

- Github workflow: readthedocs, build, formatting, coverage, etc.

- Implement interface for live bot orchestration

- Develop central orchestration app

- Integrate with Telegram

- Market making example using ARMA, ARIMA, or GARCH on the underlying asset.

- Example using different skew profiles for inventory management.

- Example demonstrating latency-aware actions.

- Example demonstrating the volume clock/event clock using

wait_next_feed. - Example demonstrating the cross-market market-making.

- Market making with alpha from the perspectives of statistical arbitrage and optimal execution.

- Queue-position-based market making for large-tick assets.

- Update the existing examples to align with version 2.0.0.