-

Notifications

You must be signed in to change notification settings - Fork 2

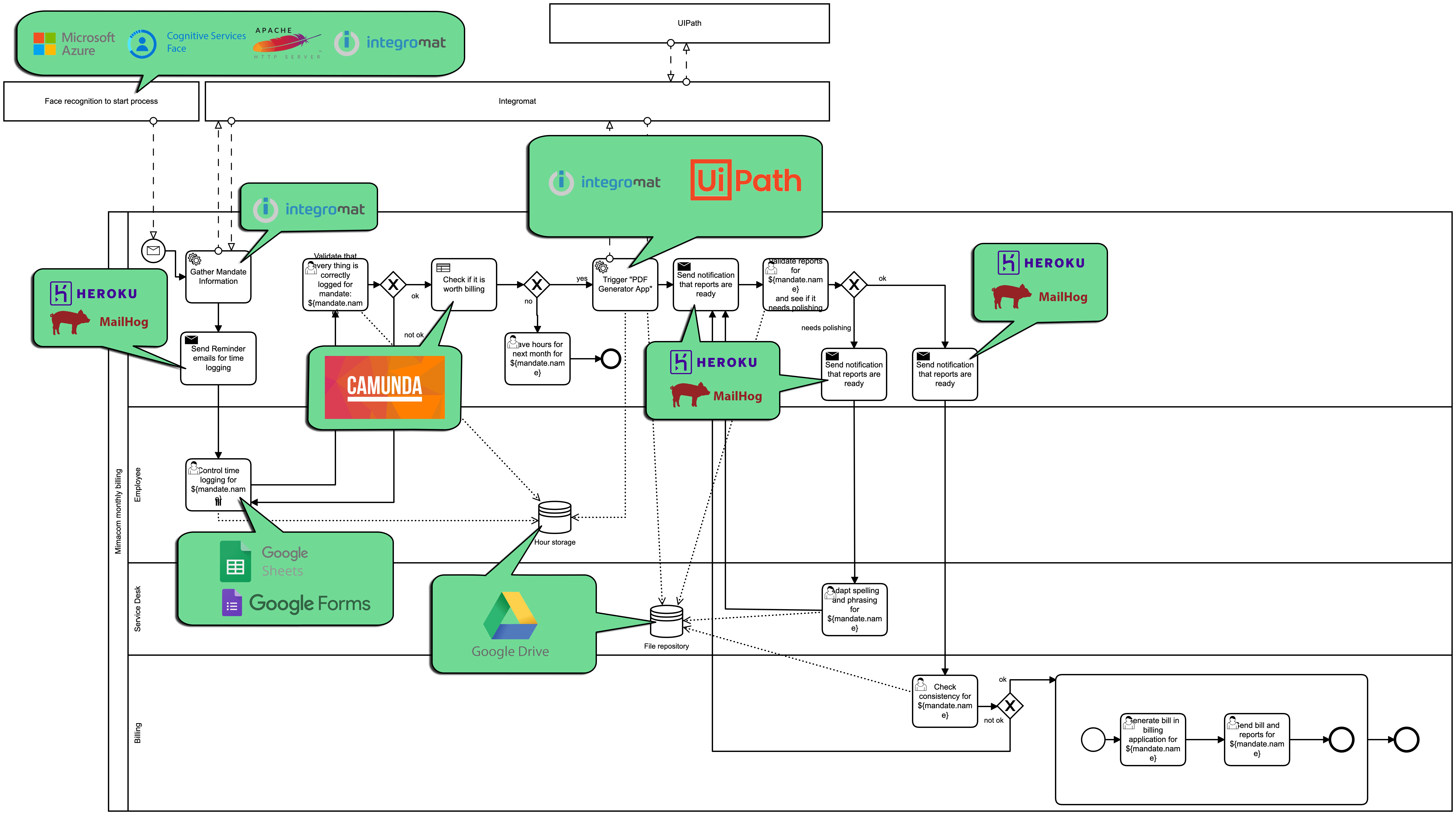

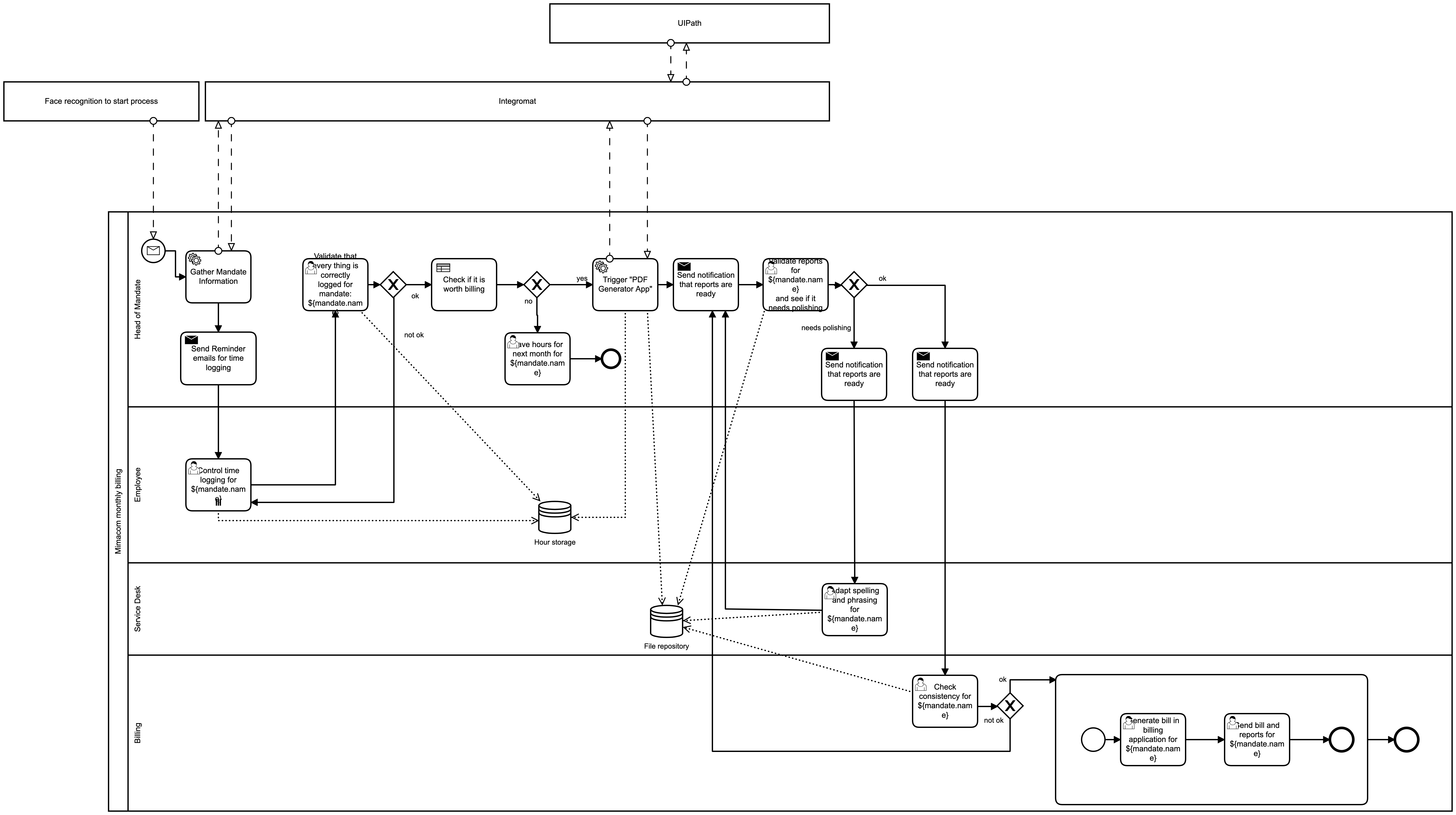

5. To Be Business Process

The "to-be process" starts when the head of mandate logs in with the facial recognition system at the end of the month (https://bikinibottom.ch/v1). An email is then automatically sent to each employee working on the mandate to remind them to fill in and check their hour report on google forms (https://forms.gle/k41PEMBpeod8YE9Z8).

The employees check and complete their time at the "project report sheet". When they are done, they validate there task. All employees and head of the mandate have access to the "project report sheet" (https://docs.google.com/spreadsheets/d/1M5nQhMNjFgTHdpEPo3avJg167zDpjLFdAYxTcIRBH0Y/edit#gid=0&fvid=1315814994), and the head of the mandate checks the entries. If he or she finds an error, he doesn't accept the task and the employees will be automatically notified that they must correct their time logs. If the logged time is valid, the Head of the mandate will fill in the hours to be billed manually. This is a manual check because he needs to include perhaps previously unbilled hours. This total of hours is passed through a decision table to decide whether it is worth sending the client a bill. this of course changes from customer to customer. If these hours aren't enough to be billed they will be stored for the next month and this instance of the process stops here. If the decision table states that it is worth sending a bill, the billing sheet will be established by an RPA call that will save the billing documents on a google drive. When the bill has been established through the API-call, the location on the drive is sent back with the response. This link will be transmitted to all further parties that have to work with the document.

In the next step, all texts for the reported times are checked. Bills that need to be improved are transferred to the Service Desk for improvement. Then the Accounting Department checks the reported time for consistency, contract specifics. If they find inconsistencies they refuse the billing and have a small explanation field to explain. If everything is correct, they generate the invoices and send them with the corresponding reports to the customers.

- Massively reduces the administrative and tracking overhead for the Heads of Mandate which have more time to focus on their primary task

- Lower process costs due to automatisation

- The entire process is less error-prone thanks to the integration of a business rule and the use of an RPA