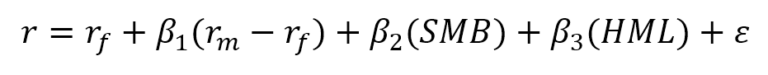

This model expands on the capital asset pricing model (CAPM) by adding size risk and value risk factors to the market risk factor in CAPM.

Where,

r = Expected rate of return

rf = Risk-free rate

ß = Factor’s coefficient (sensitivity)

(rm – rf) = Market risk premium

SMB (Small Minus Big) = Historic excess returns of small-cap companies over large-cap companies

HML (High Minus Low) = Historic excess returns of value stocks (high book-to-price ratio) over growth stocks (low book-to-price ratio)

↋ = Risk